Today at Kohl’s, I watched a lady in front of me at checkout light up when she was offered a store credit card. She signed up on the spot, saved $27 on her purchase, and walked away smiling. I was happy for her to save some money, but wish she knew what I knew about credit.

On the surface, it looks like a win — instant savings with almost no effort. But here’s the problem: those $27 in savings could end up costing her far more in the long run.

The Instant Gratification Trap

Department store credit cards are designed to hook you at your most impulsive moment: the checkout line. They offer a quick discount, but rarely do shoppers stop to think about:

- Long-term impact on your credit – Every new card means a hard inquiry and a drop (even if small) in your credit score. Too many cards can make it harder to get approved for better offers later.

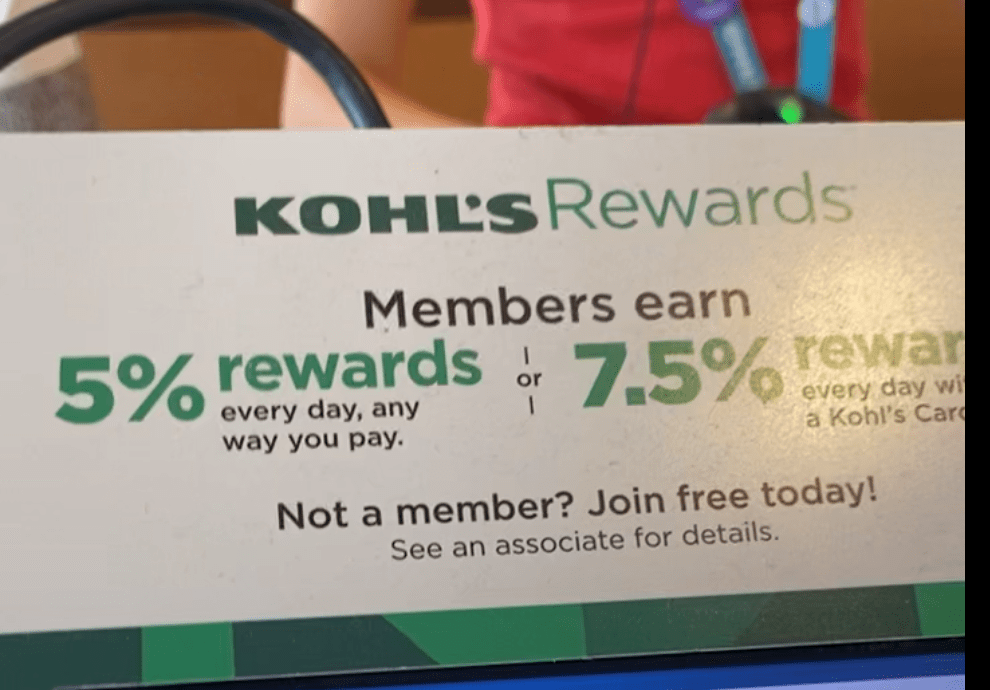

- Low rewards value – Most store cards limit your rewards to in-store credits or coupons, locking you into spending at that one store.

- High interest rates – Store cards often have APRs over 25%. If you don’t pay in full, that $27 savings is gone in a month.

- Missed opportunities – That credit card slot could be used for a card that earns transferable travel points, cash back, or other rewards that add up to hundreds (or thousands) of dollars over time.

Make Your Credit Work for You

If you’re going to add a credit card to your wallet, make sure it’s worth it. Instead of chasing a one-time $27 discount:

- Look for sign-up bonuses that give you hundreds of dollars in travel or cash back.

- Choose cards with ongoing rewards that fit your everyday spending habits.

- Think about long-term goals — whether that’s free flights, hotel stays, or building your credit for big purchases.

Smart Credit = Big Rewards

Credit cards can be a huge benefit if you plan them strategically. The right card can open the door to incredible points-and-miles opportunities, letting you travel more for less — and you can still buy from Kohl’s or HomeGoods without being locked into their credit ecosystem.

I’m working on a Beginner’s Guide to Points and Miles to help you make smart choices with credit cards so you can get more than a one-time $27 win. Stay tuned!

Leave a comment